Like most parents it seems like there is a never ending supply of questions to go alongside raising our kids – unfortunately for us, nothing comes with a manual when it comes to our kids so I am always so appreciative of the experts in certain fields that take the time to patiently answer my millions (upon millions) of questions!

Just recently I attended a twitter party with @RBC_Canada and had a lot of my own questions answered and learned very quickly that quite a few of us have the same questions and concerns when it comes to our children’s education savings – there is always a flurry of information on the internet but it certainly put my mind at ease to hear so much of it from a trusted source.

My biggest question about an RESP was always – What happens if my child chooses to not pursue secondary education? Seems like a question a lot of parents have, we don’t know what the future will hold for our children! I was happy to learn that the money we have put into her RESP won’t go to waste, the RESP can remain open for up to 36 years, upon cancellation of the plan it can either be transferred over to another sibling or it can rollover into an RRSP for your child. You can also withdraw your original contribution and not be taxed – though grant monies earned throughout the period do need to be repaid. Nice to know there are options – I’m wishing I had an RESP set up for myself when I was younger, I would have quite a nice RRSP nest egg right now!

This was my top question that was answered, but there was much more information shared that I am so glad someone asked!

Did you know….

- Low income families may qualify for an additional $2000 grant without ever having to contribute

- You can contribute into an RESP up until the end of the year of your child’s 17th birthday

- You can’t open an RESP without your child’s SIN number, but the sooner you start saving – the better.

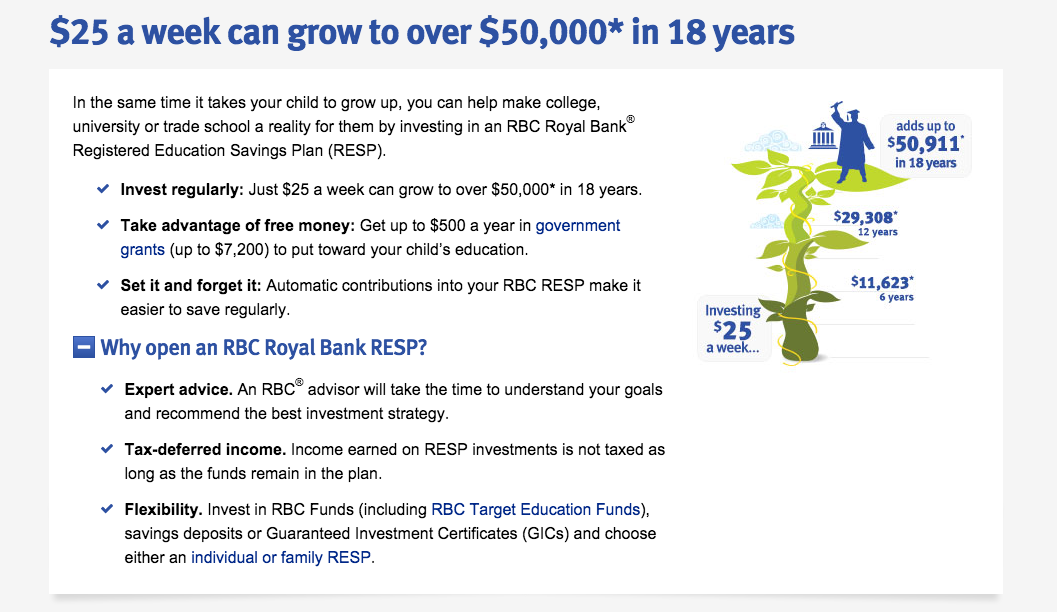

- Investing $100 a month has the potential to grow to over $50,000 in education funds by your child’s 18th birthday

- You don’t need to withdraw the money all at once, you can take it out over time. There is no maximum annual withdrawal amount

- You are eligible for free money from the government just by starting an RESP, don’t miss the chance!

I know you probably have more questions, if you’d like anymore information on RESP’s, how to start and maintain an account for your child, what they can use it towards and more visit your local RBC branch or visit the RBC website, they have RESP experts waiting to answer any questions you may have.

Want a chance to win with RBC? Enter the Grow your RESP contest. Participants will have a chance to win 1 of 4 prizes of $500 to put towards their won RESP. Contest ends October 4, 2015. Enter now!

{Disclosure: I am part of the #RESPwithRBC Influence Central campaign, I receive special perks for my affiliation. All opinions are my own.}

I always wondered what happened to that money if my kids did not pursue post secondary education–good to know it can be rolled over into an RRSP! All three of my kids have one–love seeing that total grow each month 🙂

Such a shame more people don’t take advantage of this.

Now I know I need a SIN first

This is wonderful. Thank you for the information!

Thank you for the information,nice to know I need a SIN first